Good. Below are 3 slides (one enhanced) which were leaked from an internal IEA PowerPoint presentation. Publicly, no one admits that Peak Oil is an issue, or even one that might be an issue over the short term. These slides say otherwise.

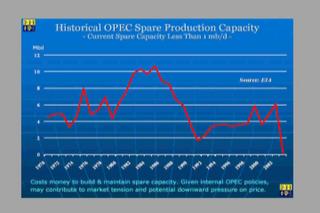

The slide above reports that the most important OPEC oil wells are:

- mature and in decline

- industry forced to exhaust wells (based on exceptionally high demand)

- Global reserves have been overstated for polital efficacy

- the industry has been forced to shift its efforts to more expensive, and riskier deep sea drilling, or extreme weather operations

- "Have to run harder just to tread water (depletion)" A DIRECT QUOTE

They warn of a supply crunch which predisposes economic collapse.

It is this sort of information which, as far as I'm concerned, makes future predictions of Peak Oil superfluous. It's the present.

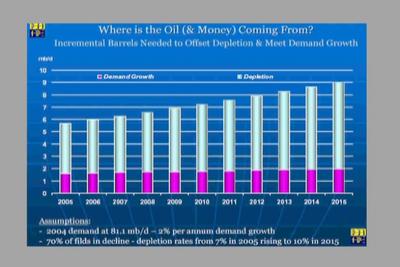

The slide above and below show very clearly that OPEC has zero excess capacity.

They assume 2004 demand to be 81mbpd (million barrels per day), and annual growth projected at increasing at 2% per year (at least 1.62 mbpd increase per annum).

It also states that 70% of fields are in decline, declining at 7% per year up to 2005, and 10% by 2015.

Let me write that equation in the simplest terms:

Each year the planet wants 2% more oil.

From now on oil supply will decline by 7%, and that decline will accelerate to 10% and beyond.

Or: 2 + (-7) = -5 (2005)

Currently, this year, that -5 is being bounced by using both the Strategic Petroleum Reserve (in the USA) and the IEA's Strategic Reserves.

When this 'supply crunch' reality hits home, and I am predicting it will be at the end of November, expect the Dollar, which is the currency used to buy oil, and the primary reserve currency, expect the Dollar to become virtually worthless.

And, as a general rule, expect more of the unexpected.

No comments:

Post a Comment