[ Wednesday, November 30, 2005 12:51:34 amAGENCIES ]

BEIJING: The H5N1 strain of bird flu seen in human cases in China has mutated as compared with strains found in human cases in Vietnam.

Chinese labs have found that the genetic order of the H5N1 virus seen in humans infected in China is different from that found in humans in Vietnam, Xinhua reported on Monday.

In China's human cases, the virus has mutated "to a certain degree", health ministry spokesman Mao Qun'an said. "But the mutation cannot cause human-to-human transmission of the avian flu," he noted.

Mao said since the bird flu first broke out in 1997, no human case has been found in Europe so far.

Indonesia bird flu case had 2 deaths in family-WHO

29 Nov 2005 13:13:18 GMT

Source: Reuters

GENEVA, Nov 29 (Reuters) - A 16-year-old boy confirmed as Indonesia's 12th human case of bird flu had two brothers who died from similar symptoms days before he was taken to hospital, the World Health Organisation (WHO) said on Tuesday.

The brothers died on Nov. 11 after being diagnosed with typhoid fever, but they were never tested for the deadly H5N1 bird flu virus, leaving questions hanging over the cause of death, WHO spokeswoman Maria Chang said.

"They had similar symptoms, fever and respiratory distress, but we don't have samples. We'll probably never have a definite diagnosis," Chang said, adding that the possibility of human-to-human transmission of bird flu could not be ruled out.

Family chickens had died shortly before the deaths of the brothers, aged 7 and 20, Chang said.

The West Java boy, whom Indonesian officials said on Saturday had tested positive for the H5N1 virus, remains in stable condition, she said.

The avian virus remains hard for people to catch but the fear is that it could mutate into a form that could be passed easily from person to person, sparking a global pandemic in which millions could die.

Asked about possible human-to-human transmission in the West Java family, Chang replied: "In theory, it could fit, but we won't have an opportunity to get samples from the brothers. No one else in the wider community is sick and that is reassuring."

A team of WHO and Indonesian health ministry investigators have gone to the village to trace contacts of the surviving brother, who entered hospital on Nov 16, according to Chang.

"We could not exclude it (human-to-human transmission), but an investigative team has gone house-to-house to 80 households and hasn't found any symptoms in the wider community," she said.

"There is no reason to think there could be any clusters."

Indonesia has had seven confirmed deaths from bird flu and the 16-year-old boy is among five known cases in the world's fourth most populous nation to survive the disease.

Bird flu has claimed 68 lives in five countries in Asia since 2003 -- Vietnam (42), Thailand (13), Indonesia (7), Cambodia (4) and China (2) -- according to the WHO.

Wednesday, November 30, 2005

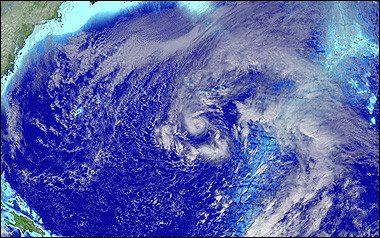

Tropical Storm Epsilon Forms in Atlantic

MIAMI - Tropical Storm Epsilon formed Tuesday in the central Atlantic and could cause dangerous surf conditions in Bermuda over the next few days, forecasters said.

But the 26th named storm of the busiest hurricane season on record was not expected to hit land, according to forecasters at the

National Hurricane Center in Miami.

What A Great Name

Handle with Care

Anyone see the movie, 'Ace Ventura Pet Detective'? Remember the opening scene where he dresses up as a delivery character, and goes out of his way to brutalise the contents of the box he is (apparently) delivering. He dropkicks it, allows it to be crushed several times in elevator doors, runs it along a wrought iron fence etc etc. Well, it looks like Ace Ventura delivered my box of books.

I'm not kidding. Digital video casette tapes literally leaked out of the soft folds (while carrying it from car to front door)which were barely held together by countless reams of South African Post Office branded duct tape.

The cardboard feels like wet toilet paper. It's weak.

And how about the contents. The hull of the box is more like a parallelogram than what it once was: a cardboard square.

Did the ship carrying my precvious cargo sail around the Wild Coast? Because a few books, including Armstrong's It's Not About the Bike, and Woolf's Mrs Dalloway got crumpled. It's a damp crumpling. I mean, the pages have turned into slightly attractive flowers, making these books almost impossible to close.

What kind of guy reads Armstrong and Virginia Woolf anyway?

I am in the process of designing a superhero brand, called Rocketboy. I have seen some shocking delivery companies, some shocking delivery processes, and practices, and here's another shocking delivery result. Imagine if you bought a can of cola and it tasted like sugar water? Is there a brand that delivers something consistently, on a daily basis? A brand that's affordable and fast, that delivers something as important but ordinary as a hamburger, or as something as precious, private (and indispensable) as a condom. Short answer: No, there isn't.

Imagine if such a brand did exist, was available at a single number, and could provide a supply line from everywhere to your home, for free.

That company is:

ROCKETBOY

It's Possible

I have had huge headaches trying to ship my computer from Korea to South Africa. They said the computer (in its tower) was 1 centre too big for their standard postal shipping. What year are we living in?

They said the same about my bicycle wheel?

When I checked in at the airport, they oohed and aahed about how heavy my baggage was, yet, you know, the airlines pack a whole shop of duty free stuff on board, from watches, to cameras, to bottles of whiskey. Now what would you rather take on board? Your luggage or a whole duty free shop?

Here's another gripe: why are airlines flying solid iron cutlery? South African Airways is. Look, by now, we've gotten over the disappointment of having our nose hairclippers, fingernail clippers, and set of allan-keys (for those who have flown their bicycles anywhere)confiscated. Yes, we get it: anything metal and sharp is a danger on board.

So if we're looking after everyone's safety, can't we extedn that to being practical with weight allowances. Less unnecessary metal should also apply to the crew. And maybe concessions can be made, obviously not without some necessary exceptions, to overseas travellers carrying a little more.

If you're travelling on SAA or Cathay Pacific and you take your bike, you can forget taking anything else.

Thus, for people with special needs (and today the consumer is exactly that, someone with special needs), fly Singapore Airlines (http://www.singaporeair.com/saa/). They're more mature, and they have a better set in their alliance (Star) than Cathay's (One World).

People are sometimes as precious as the cargo they carry with them...

Justus has an awesome photo of the Toyota Prius (a very succesful hybrid) superimposed against the cooling towers of the coal power station (far background in the above picture). I've had a look at the latest issue of Heartland and it's by far the best issue. I'm really happy that my two articles are surrounded by so much quality.

Yes, this kitten is drinking off Fransa's dog. Now, think about this. The kitten is removed from the mother too early. The baby kitten needs to feed. It finds itself in the company of a female dog. The dog hasn't had puppies in years. The kitten finds a nipple, and in a few days (hours?) nature has found a way. Is the same thing possible, I wonder (evil grin), in people?

Tuesday, November 29, 2005

On The Prospects Of Using AAA Type Batteries As Peak Oil Mitigation Devices, and Other Observations

Joseph Tainter in his groundbreaking book The Collapse Of Complex Societies makes the following trivial, but nonetheless tantalizing observation: "The number of challenges with which the Universe can confront a society is, for practical purposes, infinite".

It will probably be noncontroversial to formulate a follow-up to the Tainter's observation thus: "The range of possible responses of a society confronted with the Universe's challenges is also, for all practical intents and purposes, infinite". We know from history that past societies have used (with a mixed record of success) a whole range of responses to their problems -- from sacrificing vestal virgins to invading and enslaving their neighbors, and from institutionalizing infanticide as a population control mechanism to reorganizing their industry and food production systems.

If the responses of our political and economic mainstream to the challenges presented to our particular society, in that very special slice of space-time that we happen to inhabit, truly represent our best shot, we are virtually guaranteed to enter a very interesting period in history (interesting as in the well-known (faux) ancient Chinese curse1, May you live in interesting times). A dispassionate observer from the outer space may watch with amazement how an incredibly complex and resourceful society of Homo economicus, armed with the most advanced technology and all of the knowledge amassed through their entire history, that is voluntarily, with determination, even enthusiastically painting itself into a corner and reduces its future options to what in the game of chess is termed zugzwang (compulsed move) -- by deferring the recognition of the Universe's challenge until the crisis that is currently clearly visible on the horizon becomes detectible through economic and monetary mechanisms, signals from which in this particular peculiar civilization apparently take precedence over the other six senses.

[I follow the modern philosophical tradition and count rational reasoning, which clearly distinguishes our kind from the rest of flora and fauna, as a sixth sense. However, it appears as if it almost doesn't matter whether we possess that prized and unique sixth sense or not, as we choose to ignore what it tells us, unless, of course, the message also becomes recognizable as a signal from the free market.]

This unique form of behavior -- idealization and absolutization of the free market -- is especially puzzling, considering that inability of the market signals to reliably serve as a long term indicator of anything at all has been established beyond any controversy, as lakes of ink have been spilled over documenting the minutia of Enron and LTCM collapses, the hazards of the current real estate bubble and other market phenomena, and as the same breed of analysts who in 1999 were seen busily convincing the public that, say, the common stock of Intel Corp. had been a bargain back then at the price of $80 a share, were spotted in 2000 spreading the message that the same Intel stock had a long way to fall at a price of about $25 a share.

Exhibit A is the argument I have seen being used all the time, starting from the Vice President Dick Cheney in televized interviews, to TV personalities characterized by Nassim Taleb as "financial entertainers of the excessively commentating variety" on the CNN's The Money Line with Lou Dobbs. This same argument is utilized explicitly and implicitly in a range of documents from pronouncements by Chief Economists to publications by IEA.

The argument goes like this (I generalize it from all these multiple sources):

Because our economy requires a lot less oil circa 2005 for each dollar of GDP that it generates than circa 1973, therefore it (the economy) is much less vulnerable to oil supply disruptions and oil price spikes than it was 30 years ago.

It is just incredible to me to hear this argument again and again in our enlightened age from such a diverse group of seemingly intelligent people (although I suspect that, say, Dick Cheney may have much more insight into the nature of our energy predicament than he is letting on). If our economy, for the sake of the argument, doubled in terms of dollars of GDP since 1973 (let's measure everything in constant dollars, adjusting for inflation), and (again, for the sake of the argument) our annual oil consumption did not change from back then, we have twice as many dollars of GDP riding on the same barrel of oil we consume, do we not? Doesn't it make the economy twice as vulnerable (as expressed in the monetary impact) to the same amount of oil shortage (as expressed in barrels), instead of less vulnerable?

Let me use this example. Let's say, thirty years ago I started a business leasing out a circa 1973 Buick as a taxi. By 2005, my business has doubled in size and revenue, and currently I lease out two super energy efficient Toyota Priuses as taxis, which together consume the same amount of fuel as the old Buick consumed alone, but produce double the revenue amount (again, in constant dollars). Say, an oil supply disruption grounds my taxi fleet. What will have a bigger impact on the economy in terms of lost revenue -- one stalled taxi or two stalled taxis? Which economy has more capacity to optimize its energy usage and find reserves for growth, instead of shrinking its GDP -- an energy inefficient economy or an energy efficient economy? Which economy is more likely to contract in the face of shortages?

[Important disclosure: I will be the last one to claim that the US economy as currently observed has utilized all possible reserves for energy efficiency. I only attempted to demonstrate the inherent speciousness of this surprisingly popular argument for "reduced vulnerability", which seems to have engulfed the crème de la crème of the political and the economic world]

The next exhibit -- exhibit B -- is a small, sloppily written, but highly opinionated, borderline arrogant article by an energy economist and author Peter Huber (who is also a senior fellow of the Manhattan Institute) that asserts such a sweepingly generalized new economic principle that it reads almost like a manifesto of the "New Age" energy economics. The article, titled Thermodynamics and Money, was published by the Forbes magazine and can be viewed here.

Huber starts with an unfortunate personal attack on the late oil geologist M. King Hubbert, stating:

"In his day M. King Hubbert was a great geologist who spent his life studying the planet's deposits of oil and gas. But as he got older, he simply lost it. His "peak oil" theory--which many people are citing these days--is a case study in junk economics."

Clearly, Mr. Huber is perfectly entitled to express his criticisms of the late M. King Hubbert or anybody else, as there are no "sacred cows" in this world. Marcus Tulius Cicero, for example, was known to have had famously described the hellenized Egyptian queen Cleopatra as a boring woman, in radical disagreement with both Gaius Julius Caesar and Marc Anthony. Thus, obviously, Peter Huber also has the right to state whatever opinion he wants on Mr. Hubbert. He is also free to characterize peak oil as a case study of junk economics, or, say, the Modern Portfolio Theory as a case study of junk geology. However, as someone who is to a degree familiar with the subject, I will humbly suggest that maybe there was more to M. King Hubbert's life work and impact than meets the eye of Peter Huber.

Nevertheless, the main idea that Huber communicates in his article is that EROEI is a false measure of energy efficiency, and thus it should stop being used, as it confuses things rather than adds value. Per Huber, it doesn't matter how much energy was spent to acquire a unit of energy; what matters only how much that final form of energy will be sold for per unit. Huber formulates it thus:

"Eroei calculations now litter the energy policy debate. Time and again they're wheeled out to explain why one form of energy just can't win--tar sands, shale, corn, wood, wind, you name it. Even quite serious journals--Science, for example--have published pieces along these lines. Energy-based books of account have just got to show a profit. In the real world, however, investors don't care a fig whether they earn positive Eroei. What they care about is dollar return on dollar invested. And the two aren't the same--nowhere close--because different forms of energy command wildly different prices. Invest ten units of 10-cent energy to capture one unit of $10 energy and you lose energy but gain dollars, and Wall Street will fund you from here to Alberta."

I believe that this may be a very happy day for Jim Kunstler, as his message about the coming Long Emergency has finally reached such a high degree of market penetration that it is being broadcast (in a slightly veiled, but clearly recognizable form) from the pages of the Forbes magazine, by a senior fellow of the Manhattan institute, no less.

What is Kunstler basically all but shouting from the rooftops? That in historically very near future the energy in such forms that can be readily utilized by our society and our infrastructure will become scarce and expensive. Everything else is a corollary, a quite obvious corollary, but a corollary nonetheless (for example, that systems such as transportation, food production and distribution, government services, living arrangements, et alia will have to either adjust to this permanent condition of scarce and expensive energy, or they will stop functioning -- with pronounced effects on other interrelated systems and the society as a whole).

What is Huber stating in his article? Essentially, the same basic message: that (in Huber's scenario above) energy will become so expensive that, after investing ten units of cheap energy to produce one unit of the "final form", consumable energy, that consumable energy will still sell at a handsome profit (why else otherwise would Wall Street care to fund such a business from here to Alberta, as Huber puts it?) In short, selling very expensive energy will be a very profitable business, but no cheaper forms of energy in a consumable form will be available. Obviously, energy production in a society thus described by Huber will be at the very center of the economy, and will remain among the few profitable activities, as many other formerly profitable businesses and entire industries will be killed off by the skyrocketing energy prices. In other words, an economic shrinkage of societal scale in the scenario formulated by Huber is unavoidable.

Moreover, who is to say that the so-called cheap energy will remain cheap, as there will be so much more of it needed -- to produce the expensive energy? Won't the increased demand cause the dearth of the formerly cheap forms of "cheap energy"? (I deliberately pose this question in a form that may be more familiar to the energy economist). Surely Mr Huber will not be arguing that the capacity to produce the cheap energy needed to produce expensive energy can be increased indefinitely at a whim, without any effect on the price and availability of that cheap energy -- otherwise he risks to be laughed out all the way out from the Manhattan institute.

It is also obvious that in the Huber's scenario a lot more overall energy will be required than before, as much more of it will be burned for the needs and within the confines of the energy industry itself and will not be usable by the rest of the economy -- except, quite likely, that it will manifest itself through dramatically increased C02 emission. That is what EROEI considerations that Huber ridicules, perhaps unwittingly, are all about -- that as more and more energy will be consumed by the energy industry itself, less and less will become available for the rest of the economy.

Furthermore, I would like to point out to all of the esteemed energy economists out there that even today, during the time of relatively cheap energy, with the economy merrily humming along, and consumer holiday shopping season being in full swing, we already have exactly the type of an energy form that fits Peter Huber's criteria: alkaline batteries. I use one of those, an AAA type, manufactured by Energizer, in my MP3 player right now as I write these lines. Sinse EROEI doesn't matter in the Huber's world, but only the price that the consumable form of energy commands in the marketplace, we probably could use AAA batteries as a decent alternative to other energy types in the post-Peak Oil scenarios; after all, this is a successful commercial technology that we are already accustomed to and have a solid understanding of, unlike other, more experimental forms of alternative energy.

We already have a huge profitable market for alkaline batteries, as evidenced by some very savvy investors and conglomerates such as Gillette and Warren Buffet's Berkshire Hathaway, which invested huge amounts of capital into battery producers like Energizer and Duracell. If we simply keep on increasing our manufacturing capacity for AAA batteries at the rate of 50% per year (which is the growth rate comparable with the one achieved during the early years of the Internet industry), in 20 years we will increase the overall AAA battery production by a factor of over 3,000 (obviously, Duracell and friends will be happy to oblige). In such Huberian world, where physical constraints play no role, the surplus AAA battery capacity, unutilized by MP3 players, vibrators, and other consumer electronics, could be used in transportation systems and such, thereby mitigating or even completely eliminating the effects of peak oil...

I just can't help but wonder, how clueless must be that segment of the respectable business magazine's audience and staff that would lend the arguments such as Huber's even a shred of credibility.

However, the epitome of cluelessness in this little survey for me is the exibit C, the article published in The Wall Street Journal titled The War Against the Car, by Stephen Moore, a member of this newspaper's editorial board (WSJ online requires subscription, but the article can be viewed here). It is really worth reading in its entirety (quoting a paragraph or two will not do it justice), if one wants to appreciate the degree to which we as a society have cut ourselves loose from the realities of the world. However, I still would like to comment on the two closing paragraphs of the article:

"The good news is that environmental groups and politicians aren't likely to break Americans from their love affair with cars -- big, convenient, safe cars -- no matter how guilty they try to make us feel for driving them. Instead they are using more subtle forms of coercion. The left is now pining for a $1-a-gallon gas tax to make driving unaffordable. Washington has also wasted over $60 billion of federal gas tax money on mass transit systems, yet fewer Americans ride them now than before the deluge of subsidies began. When the voters in car-crazed Los Angeles opted to fund an ill-fated subway system, most drivers who voted "yes" said they did so because they hoped it would compel other people off the crowded highways.

To be sure, if the entire membership of the Sierra Club and Greenpeace surrendered their cars, the world and the highways might very well be a better place. But for the rest of us the car is indispensable -- it is our exoskeleton. There's a perfectly good reason that the roads are crammed with tens of millions of cars and that Americans drive eight billion miles a year while spurning buses, trains, bicycles and subways. Americans are rugged individualists who don't want to cram aboard buses and subways. We want more open roads and highways, and we want energy policies that will make gas cheaper, not more expensive. We want to travel down the road from serfdom and the car is what will take us there."

It is quite clear that we, Americans, are suffering from an acute form of hystorical Alzheimer's desease, for which we may have to pay extremely dearly. We forget that "the end of history" as proclaimed by Francis Fukuyama, turned out to be a dangerous fantasy in the early XXI century. Apparently, many of us feel that we can always get what we want, if only our governing bodies develop the right policies. We have no appreciation for the specialness and uniqueness of our current transitory historical period, during which we still have options, and we mindlessly let this period lapse and thereby foreclose those options forever. We don't understand that ruthless competition for resources is much more common and much more fundamental as a driving force of history than, say, our cherished notions of democracy, human rights, and public welfare. We don't realize that investing into the infrastructure alternative to "big, convenient, safe cars" that we have such a strong love affair with today is what may save our economy from total paralysis in historically very near future, allow it to regroup, and thereby give our civilization a chance to fight another day. We think that our political and business leaders will solve these problems for us -- well, guess what -- our political and business leaders read Forbes and Wall Street Journal, and make public pronouncements in the spirit of the above argument by Dick Cheney. We are an infantile civilization that may be foreclosing its chance to grow up.

To close on a lighter note, I recommend the following debate (MP3 file is available here; approx. 52 minutes long) between Jim Kunstler and the energy analyst Michael Lynch on the issue of oil, hosted by Christopher Lydon from National Public Radio. At the end of the debate, at the point of summarizing the show, the host makes the following remark (at 50:04 on the audio file), followed by this reply:

CL: "Walkable cities, denser living, I mean -- these are all good things, but my verdict would be, just on the hour, Mr. Kunstler, that you haven't shown us that they will be absolutely required."

JHK: "Well, I mean -- I don't know what I have to do -- jump up and down and go 'woo, woo, woo'?!"

1. As was pointed out to me in the reader commentaries below, this so-called "ancient Chinese curse" is neither Chinese, nor ancient. It appears most likely to be a product of the American culture. This and this pages, for example, provide satisfactory explanations. Interestingly, this occurence of faux ethnic (mis)attribution is far from unique. For instance, the cultural phenomenon that is known in the US as Russian roulette in the Russian culture, in which I grew up, is known as American roulette. Only one of these attributions can be right, or they can both be wrong. But they are unlikely to be both correct at the same time!

It will probably be noncontroversial to formulate a follow-up to the Tainter's observation thus: "The range of possible responses of a society confronted with the Universe's challenges is also, for all practical intents and purposes, infinite". We know from history that past societies have used (with a mixed record of success) a whole range of responses to their problems -- from sacrificing vestal virgins to invading and enslaving their neighbors, and from institutionalizing infanticide as a population control mechanism to reorganizing their industry and food production systems.

If the responses of our political and economic mainstream to the challenges presented to our particular society, in that very special slice of space-time that we happen to inhabit, truly represent our best shot, we are virtually guaranteed to enter a very interesting period in history (interesting as in the well-known (faux) ancient Chinese curse1, May you live in interesting times). A dispassionate observer from the outer space may watch with amazement how an incredibly complex and resourceful society of Homo economicus, armed with the most advanced technology and all of the knowledge amassed through their entire history, that is voluntarily, with determination, even enthusiastically painting itself into a corner and reduces its future options to what in the game of chess is termed zugzwang (compulsed move) -- by deferring the recognition of the Universe's challenge until the crisis that is currently clearly visible on the horizon becomes detectible through economic and monetary mechanisms, signals from which in this particular peculiar civilization apparently take precedence over the other six senses.

[I follow the modern philosophical tradition and count rational reasoning, which clearly distinguishes our kind from the rest of flora and fauna, as a sixth sense. However, it appears as if it almost doesn't matter whether we possess that prized and unique sixth sense or not, as we choose to ignore what it tells us, unless, of course, the message also becomes recognizable as a signal from the free market.]

This unique form of behavior -- idealization and absolutization of the free market -- is especially puzzling, considering that inability of the market signals to reliably serve as a long term indicator of anything at all has been established beyond any controversy, as lakes of ink have been spilled over documenting the minutia of Enron and LTCM collapses, the hazards of the current real estate bubble and other market phenomena, and as the same breed of analysts who in 1999 were seen busily convincing the public that, say, the common stock of Intel Corp. had been a bargain back then at the price of $80 a share, were spotted in 2000 spreading the message that the same Intel stock had a long way to fall at a price of about $25 a share.

Exhibit A is the argument I have seen being used all the time, starting from the Vice President Dick Cheney in televized interviews, to TV personalities characterized by Nassim Taleb as "financial entertainers of the excessively commentating variety" on the CNN's The Money Line with Lou Dobbs. This same argument is utilized explicitly and implicitly in a range of documents from pronouncements by Chief Economists to publications by IEA.

The argument goes like this (I generalize it from all these multiple sources):

Because our economy requires a lot less oil circa 2005 for each dollar of GDP that it generates than circa 1973, therefore it (the economy) is much less vulnerable to oil supply disruptions and oil price spikes than it was 30 years ago.

It is just incredible to me to hear this argument again and again in our enlightened age from such a diverse group of seemingly intelligent people (although I suspect that, say, Dick Cheney may have much more insight into the nature of our energy predicament than he is letting on). If our economy, for the sake of the argument, doubled in terms of dollars of GDP since 1973 (let's measure everything in constant dollars, adjusting for inflation), and (again, for the sake of the argument) our annual oil consumption did not change from back then, we have twice as many dollars of GDP riding on the same barrel of oil we consume, do we not? Doesn't it make the economy twice as vulnerable (as expressed in the monetary impact) to the same amount of oil shortage (as expressed in barrels), instead of less vulnerable?

Let me use this example. Let's say, thirty years ago I started a business leasing out a circa 1973 Buick as a taxi. By 2005, my business has doubled in size and revenue, and currently I lease out two super energy efficient Toyota Priuses as taxis, which together consume the same amount of fuel as the old Buick consumed alone, but produce double the revenue amount (again, in constant dollars). Say, an oil supply disruption grounds my taxi fleet. What will have a bigger impact on the economy in terms of lost revenue -- one stalled taxi or two stalled taxis? Which economy has more capacity to optimize its energy usage and find reserves for growth, instead of shrinking its GDP -- an energy inefficient economy or an energy efficient economy? Which economy is more likely to contract in the face of shortages?

[Important disclosure: I will be the last one to claim that the US economy as currently observed has utilized all possible reserves for energy efficiency. I only attempted to demonstrate the inherent speciousness of this surprisingly popular argument for "reduced vulnerability", which seems to have engulfed the crème de la crème of the political and the economic world]

The next exhibit -- exhibit B -- is a small, sloppily written, but highly opinionated, borderline arrogant article by an energy economist and author Peter Huber (who is also a senior fellow of the Manhattan Institute) that asserts such a sweepingly generalized new economic principle that it reads almost like a manifesto of the "New Age" energy economics. The article, titled Thermodynamics and Money, was published by the Forbes magazine and can be viewed here.

Huber starts with an unfortunate personal attack on the late oil geologist M. King Hubbert, stating:

"In his day M. King Hubbert was a great geologist who spent his life studying the planet's deposits of oil and gas. But as he got older, he simply lost it. His "peak oil" theory--which many people are citing these days--is a case study in junk economics."

Clearly, Mr. Huber is perfectly entitled to express his criticisms of the late M. King Hubbert or anybody else, as there are no "sacred cows" in this world. Marcus Tulius Cicero, for example, was known to have had famously described the hellenized Egyptian queen Cleopatra as a boring woman, in radical disagreement with both Gaius Julius Caesar and Marc Anthony. Thus, obviously, Peter Huber also has the right to state whatever opinion he wants on Mr. Hubbert. He is also free to characterize peak oil as a case study of junk economics, or, say, the Modern Portfolio Theory as a case study of junk geology. However, as someone who is to a degree familiar with the subject, I will humbly suggest that maybe there was more to M. King Hubbert's life work and impact than meets the eye of Peter Huber.

Nevertheless, the main idea that Huber communicates in his article is that EROEI is a false measure of energy efficiency, and thus it should stop being used, as it confuses things rather than adds value. Per Huber, it doesn't matter how much energy was spent to acquire a unit of energy; what matters only how much that final form of energy will be sold for per unit. Huber formulates it thus:

"Eroei calculations now litter the energy policy debate. Time and again they're wheeled out to explain why one form of energy just can't win--tar sands, shale, corn, wood, wind, you name it. Even quite serious journals--Science, for example--have published pieces along these lines. Energy-based books of account have just got to show a profit. In the real world, however, investors don't care a fig whether they earn positive Eroei. What they care about is dollar return on dollar invested. And the two aren't the same--nowhere close--because different forms of energy command wildly different prices. Invest ten units of 10-cent energy to capture one unit of $10 energy and you lose energy but gain dollars, and Wall Street will fund you from here to Alberta."

I believe that this may be a very happy day for Jim Kunstler, as his message about the coming Long Emergency has finally reached such a high degree of market penetration that it is being broadcast (in a slightly veiled, but clearly recognizable form) from the pages of the Forbes magazine, by a senior fellow of the Manhattan institute, no less.

What is Kunstler basically all but shouting from the rooftops? That in historically very near future the energy in such forms that can be readily utilized by our society and our infrastructure will become scarce and expensive. Everything else is a corollary, a quite obvious corollary, but a corollary nonetheless (for example, that systems such as transportation, food production and distribution, government services, living arrangements, et alia will have to either adjust to this permanent condition of scarce and expensive energy, or they will stop functioning -- with pronounced effects on other interrelated systems and the society as a whole).

What is Huber stating in his article? Essentially, the same basic message: that (in Huber's scenario above) energy will become so expensive that, after investing ten units of cheap energy to produce one unit of the "final form", consumable energy, that consumable energy will still sell at a handsome profit (why else otherwise would Wall Street care to fund such a business from here to Alberta, as Huber puts it?) In short, selling very expensive energy will be a very profitable business, but no cheaper forms of energy in a consumable form will be available. Obviously, energy production in a society thus described by Huber will be at the very center of the economy, and will remain among the few profitable activities, as many other formerly profitable businesses and entire industries will be killed off by the skyrocketing energy prices. In other words, an economic shrinkage of societal scale in the scenario formulated by Huber is unavoidable.

Moreover, who is to say that the so-called cheap energy will remain cheap, as there will be so much more of it needed -- to produce the expensive energy? Won't the increased demand cause the dearth of the formerly cheap forms of "cheap energy"? (I deliberately pose this question in a form that may be more familiar to the energy economist). Surely Mr Huber will not be arguing that the capacity to produce the cheap energy needed to produce expensive energy can be increased indefinitely at a whim, without any effect on the price and availability of that cheap energy -- otherwise he risks to be laughed out all the way out from the Manhattan institute.

It is also obvious that in the Huber's scenario a lot more overall energy will be required than before, as much more of it will be burned for the needs and within the confines of the energy industry itself and will not be usable by the rest of the economy -- except, quite likely, that it will manifest itself through dramatically increased C02 emission. That is what EROEI considerations that Huber ridicules, perhaps unwittingly, are all about -- that as more and more energy will be consumed by the energy industry itself, less and less will become available for the rest of the economy.

Furthermore, I would like to point out to all of the esteemed energy economists out there that even today, during the time of relatively cheap energy, with the economy merrily humming along, and consumer holiday shopping season being in full swing, we already have exactly the type of an energy form that fits Peter Huber's criteria: alkaline batteries. I use one of those, an AAA type, manufactured by Energizer, in my MP3 player right now as I write these lines. Sinse EROEI doesn't matter in the Huber's world, but only the price that the consumable form of energy commands in the marketplace, we probably could use AAA batteries as a decent alternative to other energy types in the post-Peak Oil scenarios; after all, this is a successful commercial technology that we are already accustomed to and have a solid understanding of, unlike other, more experimental forms of alternative energy.

We already have a huge profitable market for alkaline batteries, as evidenced by some very savvy investors and conglomerates such as Gillette and Warren Buffet's Berkshire Hathaway, which invested huge amounts of capital into battery producers like Energizer and Duracell. If we simply keep on increasing our manufacturing capacity for AAA batteries at the rate of 50% per year (which is the growth rate comparable with the one achieved during the early years of the Internet industry), in 20 years we will increase the overall AAA battery production by a factor of over 3,000 (obviously, Duracell and friends will be happy to oblige). In such Huberian world, where physical constraints play no role, the surplus AAA battery capacity, unutilized by MP3 players, vibrators, and other consumer electronics, could be used in transportation systems and such, thereby mitigating or even completely eliminating the effects of peak oil...

I just can't help but wonder, how clueless must be that segment of the respectable business magazine's audience and staff that would lend the arguments such as Huber's even a shred of credibility.

However, the epitome of cluelessness in this little survey for me is the exibit C, the article published in The Wall Street Journal titled The War Against the Car, by Stephen Moore, a member of this newspaper's editorial board (WSJ online requires subscription, but the article can be viewed here). It is really worth reading in its entirety (quoting a paragraph or two will not do it justice), if one wants to appreciate the degree to which we as a society have cut ourselves loose from the realities of the world. However, I still would like to comment on the two closing paragraphs of the article:

"The good news is that environmental groups and politicians aren't likely to break Americans from their love affair with cars -- big, convenient, safe cars -- no matter how guilty they try to make us feel for driving them. Instead they are using more subtle forms of coercion. The left is now pining for a $1-a-gallon gas tax to make driving unaffordable. Washington has also wasted over $60 billion of federal gas tax money on mass transit systems, yet fewer Americans ride them now than before the deluge of subsidies began. When the voters in car-crazed Los Angeles opted to fund an ill-fated subway system, most drivers who voted "yes" said they did so because they hoped it would compel other people off the crowded highways.

To be sure, if the entire membership of the Sierra Club and Greenpeace surrendered their cars, the world and the highways might very well be a better place. But for the rest of us the car is indispensable -- it is our exoskeleton. There's a perfectly good reason that the roads are crammed with tens of millions of cars and that Americans drive eight billion miles a year while spurning buses, trains, bicycles and subways. Americans are rugged individualists who don't want to cram aboard buses and subways. We want more open roads and highways, and we want energy policies that will make gas cheaper, not more expensive. We want to travel down the road from serfdom and the car is what will take us there."

It is quite clear that we, Americans, are suffering from an acute form of hystorical Alzheimer's desease, for which we may have to pay extremely dearly. We forget that "the end of history" as proclaimed by Francis Fukuyama, turned out to be a dangerous fantasy in the early XXI century. Apparently, many of us feel that we can always get what we want, if only our governing bodies develop the right policies. We have no appreciation for the specialness and uniqueness of our current transitory historical period, during which we still have options, and we mindlessly let this period lapse and thereby foreclose those options forever. We don't understand that ruthless competition for resources is much more common and much more fundamental as a driving force of history than, say, our cherished notions of democracy, human rights, and public welfare. We don't realize that investing into the infrastructure alternative to "big, convenient, safe cars" that we have such a strong love affair with today is what may save our economy from total paralysis in historically very near future, allow it to regroup, and thereby give our civilization a chance to fight another day. We think that our political and business leaders will solve these problems for us -- well, guess what -- our political and business leaders read Forbes and Wall Street Journal, and make public pronouncements in the spirit of the above argument by Dick Cheney. We are an infantile civilization that may be foreclosing its chance to grow up.

To close on a lighter note, I recommend the following debate (MP3 file is available here; approx. 52 minutes long) between Jim Kunstler and the energy analyst Michael Lynch on the issue of oil, hosted by Christopher Lydon from National Public Radio. At the end of the debate, at the point of summarizing the show, the host makes the following remark (at 50:04 on the audio file), followed by this reply:

CL: "Walkable cities, denser living, I mean -- these are all good things, but my verdict would be, just on the hour, Mr. Kunstler, that you haven't shown us that they will be absolutely required."

JHK: "Well, I mean -- I don't know what I have to do -- jump up and down and go 'woo, woo, woo'?!"

1. As was pointed out to me in the reader commentaries below, this so-called "ancient Chinese curse" is neither Chinese, nor ancient. It appears most likely to be a product of the American culture. This and this pages, for example, provide satisfactory explanations. Interestingly, this occurence of faux ethnic (mis)attribution is far from unique. For instance, the cultural phenomenon that is known in the US as Russian roulette in the Russian culture, in which I grew up, is known as American roulette. Only one of these attributions can be right, or they can both be wrong. But they are unlikely to be both correct at the same time!

Kunstler: Season's Greetings

November 28, 2005

Observers are already writing off 2005 as if it had shown us everything it has to show. I think the holiday frenzy will be as instructive as the hurricanes of late summer.

A mild late-autumn combined with extra imports of European oil and refined fuels, and withdrawals from our own strategic reserve, have held the gasoline prices down here in the US. But the northeast got a four-day cold blast over Thanksgiving, along with a substantial snowfall, and the furnaces are now cranking away, even as the WalMart shoppers commenced their first mad tramplings of the season.

Natural gas, methane, which powers half the home furnaces in America, is a separate story from oil, of course. We can't import it like oil because it requires special pressurized tanker ships and dedicated port facilities -- of which there are currently only two in America -- and getting it here by those means even if the facilities were in place would be very un-cheap. We are way past all-time peak natural gas production in the US, meanwhile, and desperately making up for it by importing all we can from Canada, which is compelled to sell us as much as we demand under the NAFTA rules, despite the fact that they are way past their own all-time gas production peak and desperately need the stuff to process the tar sands of Alberta into oil (which China has contracted to buy a great deal of). You may have noticed, too, that Canada is a northerly nation with significant home heating needs of its own.

The price of natural gas is back to where it was just after Katrina-and-Rita : about $11.50, which is roughly 400 percent higher than it was as recently as 2002. Even so, we've barely seen the effects of that yet and the prospects are that it will go much higher before this winter is over. The longstanding assumption that home heating comes cheap will go down hard in this country. The homebuilding industry is going to get crushed. They will be stuck with tens of thousands of already-built spec houses in the larger-than-3000 square foot range, with great rooms, lawyer foyers, and other heat-sucking features, and they will have tens of thousands more of them under construction or tagging close behind in the permitting process. Practically all of them will be located in the remotest suburban asteroid belts, since the closer-in ones have already been built on.

Add to this predicament the number of people already living in houses like this who may be desperately looking to get out of an increasingly ominous trap, perhaps compounded by additional problems with "creative" mortgages that have left them leveraged above their eyeballs. Some of them will be looking at heating bills as high as their monthly mortgage payments around Christmas time. If enough of them panic this winter, the housing bubble, which is already deflating, will simply fly to tatters and shreds. The high cost of home heating is the IED of the housing bubble.

American economists will be shocked to discover that the housing bubble had virtually become the US economy, and that all their bullshit about "productivity," and the "consumer sector," and the idiotic metrics that they employed to rationalize their errors, will no longer conceal the fundamental unhealth of our collective behavior. The lack of new mortgages alone will throw the financial world into a fugue of affliction, and the experience will be especially severe for the pension groups who tossed their capital into the black hole of derivatives trading.

The tragic part of all this is that we have become such a foolish and craven people, so lost in our endless victory laps, incessant self-awards, and failures of attention, that we will deserve everything that reality throws at us. We are past the point of being unworthy of our own history, so maybe we ought to stop pretending to celebrate it.

Observers are already writing off 2005 as if it had shown us everything it has to show. I think the holiday frenzy will be as instructive as the hurricanes of late summer.

A mild late-autumn combined with extra imports of European oil and refined fuels, and withdrawals from our own strategic reserve, have held the gasoline prices down here in the US. But the northeast got a four-day cold blast over Thanksgiving, along with a substantial snowfall, and the furnaces are now cranking away, even as the WalMart shoppers commenced their first mad tramplings of the season.

Natural gas, methane, which powers half the home furnaces in America, is a separate story from oil, of course. We can't import it like oil because it requires special pressurized tanker ships and dedicated port facilities -- of which there are currently only two in America -- and getting it here by those means even if the facilities were in place would be very un-cheap. We are way past all-time peak natural gas production in the US, meanwhile, and desperately making up for it by importing all we can from Canada, which is compelled to sell us as much as we demand under the NAFTA rules, despite the fact that they are way past their own all-time gas production peak and desperately need the stuff to process the tar sands of Alberta into oil (which China has contracted to buy a great deal of). You may have noticed, too, that Canada is a northerly nation with significant home heating needs of its own.

The price of natural gas is back to where it was just after Katrina-and-Rita : about $11.50, which is roughly 400 percent higher than it was as recently as 2002. Even so, we've barely seen the effects of that yet and the prospects are that it will go much higher before this winter is over. The longstanding assumption that home heating comes cheap will go down hard in this country. The homebuilding industry is going to get crushed. They will be stuck with tens of thousands of already-built spec houses in the larger-than-3000 square foot range, with great rooms, lawyer foyers, and other heat-sucking features, and they will have tens of thousands more of them under construction or tagging close behind in the permitting process. Practically all of them will be located in the remotest suburban asteroid belts, since the closer-in ones have already been built on.

Add to this predicament the number of people already living in houses like this who may be desperately looking to get out of an increasingly ominous trap, perhaps compounded by additional problems with "creative" mortgages that have left them leveraged above their eyeballs. Some of them will be looking at heating bills as high as their monthly mortgage payments around Christmas time. If enough of them panic this winter, the housing bubble, which is already deflating, will simply fly to tatters and shreds. The high cost of home heating is the IED of the housing bubble.

American economists will be shocked to discover that the housing bubble had virtually become the US economy, and that all their bullshit about "productivity," and the "consumer sector," and the idiotic metrics that they employed to rationalize their errors, will no longer conceal the fundamental unhealth of our collective behavior. The lack of new mortgages alone will throw the financial world into a fugue of affliction, and the experience will be especially severe for the pension groups who tossed their capital into the black hole of derivatives trading.

The tragic part of all this is that we have become such a foolish and craven people, so lost in our endless victory laps, incessant self-awards, and failures of attention, that we will deserve everything that reality throws at us. We are past the point of being unworthy of our own history, so maybe we ought to stop pretending to celebrate it.

On The Run

The counter has started screaming upward as of late. Am I getting a hundred hits a day now?

Yesterday I took out a 1 year membership at Virgin Active. 6 months is just under R2000 and 1 year is just over R2000. Anyway, for those (in South Africa), who keep asking me, “How long do you intend to stay?” and sometimes, appended to that “-in Bloemfontein?” you now have your answer: “At least 1 year.”

Sitting in the booth, talking to a fitness consultant, I felt an irresistible urge to train. Bloemfontein’s Virgin Active is one of the best in the world. I can say that, because I have trained in gym’s all over the world. This facility has all the stuff a gym needs, under one roof. The pool is built into the training area, so that the balcony overlooks the pool. It has plenty of parking, an important for any good gym: it doesn’t get overcrowded because it’s designed as a sort of spacious warehouse. I’ll try to take some pictures, if they’ll let me.

For those of you who want pictures of specific sights in Bloemfontein, tell me what you want and I’ll see what I can do. I’ll probably get some pictures of the Waterfront, College Square and Mimosa up sometime this evening. If it’s boring for the Bloemfonteiners reading this blog, well, it’s not meant for you: it’s meant for people very far from home. Daniel, this means you.

Although I’ve signed up, the membership only kicks in on Thursday (December 1st). I did this intentionally because I am still not feeling as fit as fiddle. I don’t wake up with a sore throat any more, but there is still a slight cough, a feeling of fever and weakness, and some gunk in my nose. The good news is I have a deep inward yearning to train, which is building, like a wave, on a daily basis. I haven’t felt that, a feeling as strong as that (to train), for a few months.

Tomorrow at 1pm I am going cycling with Francois Vorster at 1pm. Just an easy run of the mill cycle on the Kimberely road. 40km.

I ran into Francois at Mimosa a few days ago. He was carrying his baby and looking around for his wife. He says he’s going to France in a few months to open a church.

It’s also Hannes’ (Ilze’s ex boyfriend’s) birthday on Friday. He turns 30. Hannes says ‘the other longhair’, Marius, will be coming down. Should be good.

Other news:

Gold is edging closer to $500

Platinum is at $1000

Leon Schuster’s latest movie has just come out, Mama Jack. He’s South Africa’s most successful and consistent filmmaker. And he’s from Bloemfontein. I’d like to interview him and possibly collaborate with a semi-serious script about the Bushmen. Something meaningful and lighthearted at the same time. I’m also trying to arrange a meeting with an ex-lecturer of mine, Manuella Lovisa, to talk about Virginia Woolf and the idea of studying English as a profession.

Have made some progress on getting details pertaining to Lance Armstrong’s visit to South Africa here. The cheapest tickets are R1000, and the most expensive R3 500.

Justus has suggested I send the H5N1 interview (see yesterday’s post) to the Mail & Guardian. Need to edit it and have Prof. Bragg fact check it. But it’s an exciting thought.

And my box arrived from South Korea over the weekend. Mostly books, and hopefully some shoes, or else I’ll have to buy some. I’m almost 1 minute late for lunch so have to run…

Yesterday I took out a 1 year membership at Virgin Active. 6 months is just under R2000 and 1 year is just over R2000. Anyway, for those (in South Africa), who keep asking me, “How long do you intend to stay?” and sometimes, appended to that “-in Bloemfontein?” you now have your answer: “At least 1 year.”

Sitting in the booth, talking to a fitness consultant, I felt an irresistible urge to train. Bloemfontein’s Virgin Active is one of the best in the world. I can say that, because I have trained in gym’s all over the world. This facility has all the stuff a gym needs, under one roof. The pool is built into the training area, so that the balcony overlooks the pool. It has plenty of parking, an important for any good gym: it doesn’t get overcrowded because it’s designed as a sort of spacious warehouse. I’ll try to take some pictures, if they’ll let me.

For those of you who want pictures of specific sights in Bloemfontein, tell me what you want and I’ll see what I can do. I’ll probably get some pictures of the Waterfront, College Square and Mimosa up sometime this evening. If it’s boring for the Bloemfonteiners reading this blog, well, it’s not meant for you: it’s meant for people very far from home. Daniel, this means you.

Although I’ve signed up, the membership only kicks in on Thursday (December 1st). I did this intentionally because I am still not feeling as fit as fiddle. I don’t wake up with a sore throat any more, but there is still a slight cough, a feeling of fever and weakness, and some gunk in my nose. The good news is I have a deep inward yearning to train, which is building, like a wave, on a daily basis. I haven’t felt that, a feeling as strong as that (to train), for a few months.

Tomorrow at 1pm I am going cycling with Francois Vorster at 1pm. Just an easy run of the mill cycle on the Kimberely road. 40km.

I ran into Francois at Mimosa a few days ago. He was carrying his baby and looking around for his wife. He says he’s going to France in a few months to open a church.

It’s also Hannes’ (Ilze’s ex boyfriend’s) birthday on Friday. He turns 30. Hannes says ‘the other longhair’, Marius, will be coming down. Should be good.

Other news:

Gold is edging closer to $500

Platinum is at $1000

Leon Schuster’s latest movie has just come out, Mama Jack. He’s South Africa’s most successful and consistent filmmaker. And he’s from Bloemfontein. I’d like to interview him and possibly collaborate with a semi-serious script about the Bushmen. Something meaningful and lighthearted at the same time. I’m also trying to arrange a meeting with an ex-lecturer of mine, Manuella Lovisa, to talk about Virginia Woolf and the idea of studying English as a profession.

Have made some progress on getting details pertaining to Lance Armstrong’s visit to South Africa here. The cheapest tickets are R1000, and the most expensive R3 500.

Justus has suggested I send the H5N1 interview (see yesterday’s post) to the Mail & Guardian. Need to edit it and have Prof. Bragg fact check it. But it’s an exciting thought.

And my box arrived from South Korea over the weekend. Mostly books, and hopefully some shoes, or else I’ll have to buy some. I’m almost 1 minute late for lunch so have to run…

Monday, November 28, 2005

Ready To Move on

Is it sleep deprivation or reverse culture shock? I have to admit, I feel a bit lost walking into a Spar or a Pick 'n Pay. When I went to Carrefour in Korea, I knew exactly what to buy. Now I am buying beetroot, avocados, boerewors, pears, Sunday newspapers...and I get food cooked for me anyway. I still feel, well...lost.

One thing that I have quickly learned to appreciate is my cellphone. If you have a girlfriend, let me assure you, it's essential. You can sms: 'I am leaving now...' or make a call from the car to let someone know they need to come out and meet you.

And before you go to sleep your girlfriend writes:

'Vreeslik dankie vir die lekker stuk kaaskoek en...en jou kuier by my. Vandag was perfek'.

Literal translation: 'Terrible thank you for the very good cheesecake and...(censored)...and your visiting me. Today was perfect.'

It just adds that little bit of quality to an already meaningful and moving day.

I know when I went to Korea I said to myself, "The first thing I'm going to get is a phone." For some reason, I never really connected. I only got my alien card within a few days of leaving. Seriously.

I do feel my semi-voluntary isolation helped me to find a very clear direction and focus, and I don't think working (teaching English in hagwon's) in Korea is a good thing beyond a certain period of time. 1 year is good. 2 years is healthy. 4 years is vrot.

As you'll notice below, transport is uppermost in my mind. In the coming weeks I need to find a domicile, a mode of transport, and a job. All fairly important choices.

It's fair to say that I am not feeling calm and serene. I feel a bit ruffled by the things I must do.

I must also say that I feel more confident in my ideas than I think I have ever felt, and far more willing to risk defeat or failure.

I am focussed now on getting a budget ready so that I can send off my Rocketboy proposal to Mark Shuttleworth.

I am reading an excellent book called Blue Ocean Strategy. I am really excited that many of my thoughts are backed up by some of the latest research and information. I really believe, done in a controlled and professional way, Rocketboy can become as fresh and powerful as Google, as an everyday utility.

I still have a slight cough and sore throat, but it's nowhere near a level that can keep me at home or from going out. With this excuse in mind, I'm going to sign up for a year at Virgin Active (that should give all you doubters who think I'll be back in the East or somewhere far from here)...and try to start gyming and exercising regularly. I see so many sexy bodies around me that I can't wait to shake off my flab. It was fun, and I'll be honest with you, somewhat titillating to have breasts. I have played with them a little in the mirror, and explored the possibilities of cleavage with a hairy chest. I'm ready to move on.

One thing that I have quickly learned to appreciate is my cellphone. If you have a girlfriend, let me assure you, it's essential. You can sms: 'I am leaving now...' or make a call from the car to let someone know they need to come out and meet you.

And before you go to sleep your girlfriend writes:

'Vreeslik dankie vir die lekker stuk kaaskoek en...en jou kuier by my. Vandag was perfek'.

Literal translation: 'Terrible thank you for the very good cheesecake and...(censored)...and your visiting me. Today was perfect.'

It just adds that little bit of quality to an already meaningful and moving day.

I know when I went to Korea I said to myself, "The first thing I'm going to get is a phone." For some reason, I never really connected. I only got my alien card within a few days of leaving. Seriously.

I do feel my semi-voluntary isolation helped me to find a very clear direction and focus, and I don't think working (teaching English in hagwon's) in Korea is a good thing beyond a certain period of time. 1 year is good. 2 years is healthy. 4 years is vrot.

As you'll notice below, transport is uppermost in my mind. In the coming weeks I need to find a domicile, a mode of transport, and a job. All fairly important choices.

It's fair to say that I am not feeling calm and serene. I feel a bit ruffled by the things I must do.

I must also say that I feel more confident in my ideas than I think I have ever felt, and far more willing to risk defeat or failure.

I am focussed now on getting a budget ready so that I can send off my Rocketboy proposal to Mark Shuttleworth.

I am reading an excellent book called Blue Ocean Strategy. I am really excited that many of my thoughts are backed up by some of the latest research and information. I really believe, done in a controlled and professional way, Rocketboy can become as fresh and powerful as Google, as an everyday utility.

I still have a slight cough and sore throat, but it's nowhere near a level that can keep me at home or from going out. With this excuse in mind, I'm going to sign up for a year at Virgin Active (that should give all you doubters who think I'll be back in the East or somewhere far from here)...and try to start gyming and exercising regularly. I see so many sexy bodies around me that I can't wait to shake off my flab. It was fun, and I'll be honest with you, somewhat titillating to have breasts. I have played with them a little in the mirror, and explored the possibilities of cleavage with a hairy chest. I'm ready to move on.

Make A Wish

When You Wish Upon A Star Do Dreams Come True?

You may recall that many (including myself) predicted that oil by the end of November (now) would be around $70. It's not. In fact it's not really near $70. Or even near $60. It's closer to $50. The good news is I must apologise if I depressed you or upset you...making you think that there was a lot to worry about starting from the end of November.

The bad news is really that the longer we can turn the peak (a rounded slope) into an extended plateau, the steeper (the harder the fall) things will change when they do.

And the bad news is, and we've known this all along, that no one really knows...we'll only know in the rear view mirror.

It's always dangerous to make predictions, because people say, "See, you were 'wrong'". The point is, we're in a crucial phase, and we need to adapt, and conserve, and change our consumption. The point remains that we need to find alternatives. And we have already run out of time, whether or not that seems obvious right now.

I am glad I was wrong about the fuel price. I have just returned from a short holiday. Like everyone else, I'd prefer a fuel bill of around R900 (W200 000) (that's a guess) for travelling about 1400km...rather that than R1400.

But wanting the fuel price to be low, wanting cheap oil doesn't mean that's a reality that we can extend indefinitely.

Wanting to stay young is something like a mixture of truth and then what is in the eye of the beholder. Sooner or later, things become what they are, and not what we want them to be, however much we wish upon our star.

Iraq set to lose billions of dollars in oil rip-off

26/11/2005

Washington D.C, Asharq Al-Awsat - Iraq is currently losing millions of dollars in “rip-off” deals between the US-backed government in Baghdad and international oil companies, a report published in London on Tuesday said.

“Crude Designs: The Rip-Off of Iraq’s Oil Wealth” revealed Iraqis were in danger of losing up to $194 billion in lost revenues, and risk handing more than 64% of the control of Iraq’s oil reserves to foreign companies. Iraq has the world’s third largest oil reserves.

Steve Kretzman, from Oil Change International who contributed to the report, said, “The Bush administration has gone to great lengths to hide the truth, but this report confirms what many had long suspected. In short, the winners for control of Iraq’s oil are the US, the UK and their oil companies. The losers are the Iraqi people.”

Published by a coalition of environmental organizations, the report indicated that long-term contracts would guarantee massive profits with rates of return between 42% and 162%, compared to an average profit of 12% in the oil industry.

Gregg Muttitt of PLATFORM, a center of expertise on oil and gas corporations in London, who researched and wrote the report said, "This form of contract being promoted is the most expensive and undemocratic option available. Iraq’s oil should be for the benefit of the Iraqi people, not foreign oil companies.”

He was referring to a type of contract known as production sharing agreements (PSAs) which he claimed have been heavily promoted by the US government and oil companies and have the backing of senior figures in the Iraqi Oil Ministry. Britain had also encouraged Iraq to open its oilfields for foreign investment. The report demonstrated that PSAs that last for 25 to 40 years, are usually secret and prevent governments from later altering the terms of the contract.

Iraqi officials have defended these contracts and said they would contribute to the development of oil-producing regions across the country. In a recent statement, Ahmad Chalabi, the Iraqi deputy prime said, “In order to increase our oil production we need to enter into PSAs.”

First developed in the 1960s, these contracts technically keep the legal ownership of oil reserves in state hands and therefore sidestep the accusation of transferring oil wealth into foreign hands, while practically, they deliver oil companies the same results as the concession agreements they replaced.

PSAs generally exempt foreign oil companies from any new laws that might affect their profits. The contracts often stipulate that disputes are heard not in the country’s own courts but in international investment tribunals.

The report warned that these contracts may be signed while the government is new and weak and the security situation dire. They are likely to be highly unfavorable but could last for up to 40 years. As such, the report called for “a full and open debate in Iraq about the way oil resources are to be developed, not 30-year deals negotiated behind closed doors.”

Not only are these deals being negotiated without public discussion, but ongoing violence in Iraq has been putting the country at a considerable disadvantage. Muttitt explained, “Iraqi’s institutions are new and weak. Experience in other countries shows that oil companies generally get the upper hand in PSA negotiations with governments. The companies will inevitably use Iraq’s current instability to push for highly advantageous terms and lock Iraq into those terms for decades.”

The Iraqi constitution adopted last October opened the way for greater foreign involvement in Iraq’s oilfields. Negotiations with oil companies are already underway, ahead of the parliamentary elections in December and prior to the passing of a new Petroleum Law.

Several influential Iraqi politicians and technocrats were responsible for pressing the government to sign long-term deals with foreign oil companies, the report found.

According to Louise Richards, Chief Executive of War on Want, a co-publisher of the report, the study demonstrates that “Iraq’s oil profits, far from being used to alleviate the suffering that the Iraqi people now face, are well within the sights of the multi-nationals.”

As an alternative, the report calls on Iraq to self finance oil production by inviting foreign oil companies to sign short term agreements with fewer constraints or by using oil profits as a guarantee to borrow the necessary funds.

In a start warning to the Iraqi people, the report claimed the country was in danger of “surrendering its democracy before it even begins.”

You may recall that many (including myself) predicted that oil by the end of November (now) would be around $70. It's not. In fact it's not really near $70. Or even near $60. It's closer to $50. The good news is I must apologise if I depressed you or upset you...making you think that there was a lot to worry about starting from the end of November.

The bad news is really that the longer we can turn the peak (a rounded slope) into an extended plateau, the steeper (the harder the fall) things will change when they do.

And the bad news is, and we've known this all along, that no one really knows...we'll only know in the rear view mirror.

It's always dangerous to make predictions, because people say, "See, you were 'wrong'". The point is, we're in a crucial phase, and we need to adapt, and conserve, and change our consumption. The point remains that we need to find alternatives. And we have already run out of time, whether or not that seems obvious right now.

I am glad I was wrong about the fuel price. I have just returned from a short holiday. Like everyone else, I'd prefer a fuel bill of around R900 (W200 000) (that's a guess) for travelling about 1400km...rather that than R1400.

But wanting the fuel price to be low, wanting cheap oil doesn't mean that's a reality that we can extend indefinitely.

Wanting to stay young is something like a mixture of truth and then what is in the eye of the beholder. Sooner or later, things become what they are, and not what we want them to be, however much we wish upon our star.

Iraq set to lose billions of dollars in oil rip-off

26/11/2005

Washington D.C, Asharq Al-Awsat - Iraq is currently losing millions of dollars in “rip-off” deals between the US-backed government in Baghdad and international oil companies, a report published in London on Tuesday said.

“Crude Designs: The Rip-Off of Iraq’s Oil Wealth” revealed Iraqis were in danger of losing up to $194 billion in lost revenues, and risk handing more than 64% of the control of Iraq’s oil reserves to foreign companies. Iraq has the world’s third largest oil reserves.

Steve Kretzman, from Oil Change International who contributed to the report, said, “The Bush administration has gone to great lengths to hide the truth, but this report confirms what many had long suspected. In short, the winners for control of Iraq’s oil are the US, the UK and their oil companies. The losers are the Iraqi people.”

Published by a coalition of environmental organizations, the report indicated that long-term contracts would guarantee massive profits with rates of return between 42% and 162%, compared to an average profit of 12% in the oil industry.

Gregg Muttitt of PLATFORM, a center of expertise on oil and gas corporations in London, who researched and wrote the report said, "This form of contract being promoted is the most expensive and undemocratic option available. Iraq’s oil should be for the benefit of the Iraqi people, not foreign oil companies.”

He was referring to a type of contract known as production sharing agreements (PSAs) which he claimed have been heavily promoted by the US government and oil companies and have the backing of senior figures in the Iraqi Oil Ministry. Britain had also encouraged Iraq to open its oilfields for foreign investment. The report demonstrated that PSAs that last for 25 to 40 years, are usually secret and prevent governments from later altering the terms of the contract.

Iraqi officials have defended these contracts and said they would contribute to the development of oil-producing regions across the country. In a recent statement, Ahmad Chalabi, the Iraqi deputy prime said, “In order to increase our oil production we need to enter into PSAs.”

First developed in the 1960s, these contracts technically keep the legal ownership of oil reserves in state hands and therefore sidestep the accusation of transferring oil wealth into foreign hands, while practically, they deliver oil companies the same results as the concession agreements they replaced.

PSAs generally exempt foreign oil companies from any new laws that might affect their profits. The contracts often stipulate that disputes are heard not in the country’s own courts but in international investment tribunals.

The report warned that these contracts may be signed while the government is new and weak and the security situation dire. They are likely to be highly unfavorable but could last for up to 40 years. As such, the report called for “a full and open debate in Iraq about the way oil resources are to be developed, not 30-year deals negotiated behind closed doors.”

Not only are these deals being negotiated without public discussion, but ongoing violence in Iraq has been putting the country at a considerable disadvantage. Muttitt explained, “Iraqi’s institutions are new and weak. Experience in other countries shows that oil companies generally get the upper hand in PSA negotiations with governments. The companies will inevitably use Iraq’s current instability to push for highly advantageous terms and lock Iraq into those terms for decades.”

The Iraqi constitution adopted last October opened the way for greater foreign involvement in Iraq’s oilfields. Negotiations with oil companies are already underway, ahead of the parliamentary elections in December and prior to the passing of a new Petroleum Law.

Several influential Iraqi politicians and technocrats were responsible for pressing the government to sign long-term deals with foreign oil companies, the report found.

According to Louise Richards, Chief Executive of War on Want, a co-publisher of the report, the study demonstrates that “Iraq’s oil profits, far from being used to alleviate the suffering that the Iraqi people now face, are well within the sights of the multi-nationals.”

As an alternative, the report calls on Iraq to self finance oil production by inviting foreign oil companies to sign short term agreements with fewer constraints or by using oil profits as a guarantee to borrow the necessary funds.

In a start warning to the Iraqi people, the report claimed the country was in danger of “surrendering its democracy before it even begins.”

If you read further you'll come across quite a few pictures of...gasp...a car. In truth, I love driving, I love drinking Coke, and I like hamburgers and beer. A lot. Driving in the Alpha GT, it's hard to imagine, having the control over such a powerful and efficient beast, that you'll ever have to give it up. I guess it's like opening a Christmas present, and it's an incredible talking robot, or a camera, but there are no batteries to run it. I have been moving around either in the Jeep or in Fransa's car. Soon I will probably have to get my own mode of transport (one level up from my Cannondale). This scooter is selling for R8 500. I'm thinking about it. I'd rather buy a car but you've got to put your money where your mouth is...and your mouth...well, do you say and do you do what you believe is true, or what you wish were true?

This was my first braai in 6 months. Justus cooked the boerewors (boerewors is to South Africans what Kimchi is to South Koreans) to perfection. It was juicy and delicious. Boerewors means 'farmer's sausage'. Sosati is the Afrikaans (and English South Africans use the word too) for kebab. Personally I think boerewors, sosati and braai and far better words to capture the taste and atmosphere than conventional English. The braai was also spur of the moment. Fransa and I arrived at 15 Torbert to drop off the GT, and by then Christo had arrived (he has a yacht in Cape Town), and then 4 more people arrived... It was a very pleasant sociable evening and it's been a good, colorful weekend.

Subscribe to:

Posts (Atom)