Everyone would like to fix the US energy policy, *but doing so is almost impossible, in my view, primarily because we need to be planning for a much bigger change than most people can even imagine.* [italics added]

***It seems to me that our international financial system is at this point, inching closer and closer to collapse. It needs growth to operate. Now that world oil supplies are virtually flat (and China and India and oil exporters are getting more of the oil), the financial system can't get enough growth momentum. The US has applied various sleight of hand techniques to try to cover this problem (see my post What's Behind US Budget Problems?), but *at some time in the not too distant future, the techniques are going to stop working, and there is going to be a major financial crash, with debt defaults.* This could happen when QE2 ends, or maybe QE3, QE4, or QE5. The timing may vary by country, with some countries holding out for a while longer.*** [italics added]

*The reason I point this out is because after such a crash, as far as I can see, everything is going to go downhill quickly.* [italics added] This is a graph of my view of one such scenario of oil supplies, if a country that imports all its oil undergoes such a collapse: Figure 1. Type of drop in oil consumption that could occur, if a country gets shut out from buying oil because of debt problems.

***The point is that the oil consumption goes down very quickly, not over a period of many years, because the decline in supply is determined by something quite different from what oil is in the ground--it is determined by ability to pay for the oil.*** A potential buyer can be cut off very quickly, if its credit is no good. We have gotten used to the idea of being able to keep running a tab, but at some point, this whole process is likely to come to a halt--something that can't go on forever, won't. Some international trade may continue, especially when a country has goods to trade for oil (rather than an IOU), but the level of free trade we have now can't be expected to continue indefinitely.

***The problem I see with a collapse scenario is that a plan that uses less oil and tries to make it go farther really isn't helpful. Thus, a gas tax, or cap-and-trade, or fuel-efficient cars, or more fossil fuel extenders like wind and solar PV really aren't helpful. Instead, we need to put our effort into figuring out how we would get along without fossil fuels and nuclear, rather than get along with less. Arguably, we may have some supply for a while, but if we do, we need to use it to help with the transition, not to expect such supply to continue forever. This is the big problem I have with energy policies and transition plans--they assume we are planning for a slow decline, when it is likely that we will not have such a decline.***

In the case of an oil producer rather than an oil importer, perhaps the situation is better, but even here, there is a question of how much will continue to be produced, if there is major political upheaval. We know that the USSR broke up at the time of its collapse. There would seem to be a substantial chance of that happening elsewhere.

***Everyone would like to add new and more complex systems to help--for example, more wind with upgraded transmission systems, smart grids, and electric cars. As nice as these might seem, the new systems become more and more complex, and more dependent on everything working together exactly correctly. As we lose ability to import spare parts, they will become very difficult to maintain, and will likely collapse within a few years. While they seem appealing, I don't think they will add very much for very long.***

*Moving to a new system will require a lot of other changes:* [italics added]

1. A different financial system, that is not dependent on debt and growth.

2. More even distribution of incomes. With much less wealth, it won't make sense for a few to have such a disproportionate share.

3. More even distribution of land. Without fossil fuels, it will not be possible to farm nearly as large plots. This also goes with more even distribution of wealth.

*Changes such as these would be very difficult to make within our current structure. But without making such changes as well, it is hard to see that the new system would work.* [italics added]

In a post a while ago, I explained some of the things that seem to me to need to be done. I called the post, What President Obama Should Have Said Regarding Energy Policy. ***I don't know that there is a real way that we can make major changes, without actually hitting a financial wall first. Perhaps a few people can work on such changes, and implement their own local versions of them.*********************************

Courtesy of William Tamblyn:

http://www.zerohedge.com/

China Proposes To Cut Two Thirds Of Its $3 Trillion In USD Holdings

Submitted by Tyler Durden on 04/24/2011 11:05 -0400

All those who were hoping global stock markets would surge tomorrow based on a ridiculous rumor that China would revalue the CNY by 10% will have to wait. Instead, China has decided to serve the world another surprise. Following last week's announcement by PBoC Governor Zhou (Where's Waldo) Xiaochuan that the country's excessive stockpile of USD reserves has to be urgently diversified, today we get a sense of just how big the upcoming Chinese defection from the "buy US debt" Nash equilibrium will be. Not surprisingly, China appears to be getting ready to cut its USD reserves by roughly the amount of dollars that was recently printed by the Fed, or $2 trilion or so. And to think that this comes just as news that the Japanese pension fund will soon be dumping who knows what. So, once again, how about that "end of QE" again?

From Xinhua:

China Proposes To Cut Two Thirds Of Its $3 Trillion In USD Holdings

Submitted by Tyler Durden on 04/24/2011 11:05 -0400

All those who were hoping global stock markets would surge tomorrow based on a ridiculous rumor that China would revalue the CNY by 10% will have to wait. Instead, China has decided to serve the world another surprise. Following last week's announcement by PBoC Governor Zhou (Where's Waldo) Xiaochuan that the country's excessive stockpile of USD reserves has to be urgently diversified, today we get a sense of just how big the upcoming Chinese defection from the "buy US debt" Nash equilibrium will be. Not surprisingly, China appears to be getting ready to cut its USD reserves by roughly the amount of dollars that was recently printed by the Fed, or $2 trilion or so. And to think that this comes just as news that the Japanese pension fund will soon be dumping who knows what. So, once again, how about that "end of QE" again?

From Xinhua:

***China's foreign exchange reserves increased by 197.4 billion U.S. dollars in the first three months of this year to 3.04 trillion U.S. dollars by the end of March.***

***Xia Bin, a member of the monetary policy committee of the central bank, said on Tuesday that 1 trillion U.S. dollars would be sufficient. He added that China should invest its foreign exchange reserves more strategically, using them to acquire resources and technology needed for the real economy.***

***Xia Bin, a member of the monetary policy committee of the central bank, said on Tuesday that 1 trillion U.S. dollars would be sufficient. He added that China should invest its foreign exchange reserves more strategically, using them to acquire resources and technology needed for the real economy.***

And as if the public sector making it all too clear what is about to happen was not enough, here is the private one as well:

China should reduce its excessive foreign exchange reserves and further diversify its holdings, Tang Shuangning, chairman of China Everbright Group, said on Saturday.

The amount of foreign exchange reserves should be restricted to between 800 billion to 1.3 trillion U.S. dollars, Tang told a forum in Beijing, saying that the current reserve amount is too high.

Tang's remarks echoed the stance of Zhou Xiaochuan, governor of China's central bank, who said on Monday that China's foreign exchange reserves "exceed our reasonable requirement" and that the government should upgrade and diversify its foreign exchange management using the excessive reserves.

Tang also said that China should further diversify its foreign exchange holdings. He suggested five channels for using the reserves, including replenishing state-owned capital in key sectors and enterprises, purchasing strategic resources, expanding overseas investment, issuing foreign bonds and improving national welfare in areas like education and health.

However, these strategies can only treat the symptoms but not the root cause, he said, noting that the key is to reform the mechanism of how the reserves are generated and managed.

The last sentence says it all. ***While China is certainly tired of recycling US Dollars, it still has no viable alternative, especially as long as its own currency is relegated to the C-grade of not even SDR-backing currencies. But that will all change very soon. Once the push for broad Chinese currency acceptance is in play, the CNY and the USD will be unpegged, promptly followed by China dumping the bulk of its USD exposure, and also sending the world a message that US debt is no longer a viable investment*** opportunity. In fact, we are confident that the reval is a likely a key preceding step to any strategic decision vis-a-vis US FX exposure (read bond purchasing/selling intentions). As such, all those Americans pushing China to revalue, may want to consider that such an action could well guarantee hyperinflation, once the Fed is stuck as being the only buyer of US debt.

The amount of foreign exchange reserves should be restricted to between 800 billion to 1.3 trillion U.S. dollars, Tang told a forum in Beijing, saying that the current reserve amount is too high.

Tang's remarks echoed the stance of Zhou Xiaochuan, governor of China's central bank, who said on Monday that China's foreign exchange reserves "exceed our reasonable requirement" and that the government should upgrade and diversify its foreign exchange management using the excessive reserves.

Tang also said that China should further diversify its foreign exchange holdings. He suggested five channels for using the reserves, including replenishing state-owned capital in key sectors and enterprises, purchasing strategic resources, expanding overseas investment, issuing foreign bonds and improving national welfare in areas like education and health.

However, these strategies can only treat the symptoms but not the root cause, he said, noting that the key is to reform the mechanism of how the reserves are generated and managed.

Spanish surrealist artist Salvador Dali epitomized eccentricity in both his life and his work, and it is his penchant for the strikingly bizarre that is so brilliantly captured in this image by the great Latvian-American portrait photographer, Philippe Halsman. Halsman worked with Dali in the 1940s, and their collaborations were compiled in the 1954 book, Dali's Mustache, in which over thirty different images of the artist's flamboyant facial hair can be found – including this famous version. As well as the popular painter's distinctive upturned waxed mustache – almost as iconic as his art – the shot shows Dali's facial expression at its oddball best, eyes wide, seeming to stare at the viewer as if from around a corner. A perfect testimony for probably the 20th century's most popular artist-celebrity, a man at once disdainfully aloof and anxious for public attention in all that he did.

Spanish surrealist artist Salvador Dali epitomized eccentricity in both his life and his work, and it is his penchant for the strikingly bizarre that is so brilliantly captured in this image by the great Latvian-American portrait photographer, Philippe Halsman. Halsman worked with Dali in the 1940s, and their collaborations were compiled in the 1954 book, Dali's Mustache, in which over thirty different images of the artist's flamboyant facial hair can be found – including this famous version. As well as the popular painter's distinctive upturned waxed mustache – almost as iconic as his art – the shot shows Dali's facial expression at its oddball best, eyes wide, seeming to stare at the viewer as if from around a corner. A perfect testimony for probably the 20th century's most popular artist-celebrity, a man at once disdainfully aloof and anxious for public attention in all that he did. Blond, curvaceous and beautiful, Marilyn Monroe epitomized the American female sex symbol. No other starlet has reached her iconic status in the popular imagination, and no other photo captures her sensuous yet innocently seductive power better than this one, snapped by Matty Zimmerman in 1954. Famously taken as Monroe posed over a Manhattan subway vent while in character for The Seven Year Itch, the picture shows the actress laughing as her skirt billows about her, blown up by a blast of warm air from below. Hundreds of photographers' flashbulbs went off at the location of the midnight scene, leaving Monroe's watching husband Joe DiMaggio enraged about the media spectacle. The couple were divorced just weeks later, but the movie was a highlight of Monroe's career, and this shot captured her still radiant, eight years prior to her "probable suicide."

Blond, curvaceous and beautiful, Marilyn Monroe epitomized the American female sex symbol. No other starlet has reached her iconic status in the popular imagination, and no other photo captures her sensuous yet innocently seductive power better than this one, snapped by Matty Zimmerman in 1954. Famously taken as Monroe posed over a Manhattan subway vent while in character for The Seven Year Itch, the picture shows the actress laughing as her skirt billows about her, blown up by a blast of warm air from below. Hundreds of photographers' flashbulbs went off at the location of the midnight scene, leaving Monroe's watching husband Joe DiMaggio enraged about the media spectacle. The couple were divorced just weeks later, but the movie was a highlight of Monroe's career, and this shot captured her still radiant, eight years prior to her "probable suicide." British Prime Minister Winston Churchill is seen as one of the great wartime leaders and a strategist who made possible the Allied victory in World War Two. However, his personal qualities – his bullishness and his belligerence – were just as key to prevailing over the Nazis. It is this essence of defiance that the 1941 picture by acclaimed Canadian portrait photographer Yousuf Karsh succeeds in capturing. The shot of the scowling statesman with his hand on his hip was taken in the House of Commons in Ottawa, where Churchill had just given an address. The story goes that Karsh angered his subject – already irritated at having not been told of the shoot – by taking the lit cigar from his lips after Churchill had refused to remove it himself. Churchill's expression did the rest, rendering him the personification of war-torn Britain – The Roaring Lion, as the photo was titled. One of the most famous photo portraits ever, it is also said to be the most widely reproduced.

British Prime Minister Winston Churchill is seen as one of the great wartime leaders and a strategist who made possible the Allied victory in World War Two. However, his personal qualities – his bullishness and his belligerence – were just as key to prevailing over the Nazis. It is this essence of defiance that the 1941 picture by acclaimed Canadian portrait photographer Yousuf Karsh succeeds in capturing. The shot of the scowling statesman with his hand on his hip was taken in the House of Commons in Ottawa, where Churchill had just given an address. The story goes that Karsh angered his subject – already irritated at having not been told of the shoot – by taking the lit cigar from his lips after Churchill had refused to remove it himself. Churchill's expression did the rest, rendering him the personification of war-torn Britain – The Roaring Lion, as the photo was titled. One of the most famous photo portraits ever, it is also said to be the most widely reproduced. When Muhammad Ali knocked out Sonny Liston in the first round of their 1965 rematch with what would become known as the “phantom punch,” the incident would go down as one of the most controversial in boxing history, as many suspected Liston had thrown the fight due to threats from the Nation of Islam, or in order to take a payoff. Nevertheless, more enduring than any cries of 'fix!' was this image, which shows Ali standing over his laid out opponent, screaming at him to “Get up and fight, sucker!” The scene was snapped by legendary sports photographer Neil Leifer at the ringside, and the picture seems to encapsulate everything the passionate, outspoken champion Ali was about. While not a typical photo portrait, it remains the single most iconic image of the man who proclaimed, “I'm the greatest,” and the most famous and heavily publicized sports photo in history.

When Muhammad Ali knocked out Sonny Liston in the first round of their 1965 rematch with what would become known as the “phantom punch,” the incident would go down as one of the most controversial in boxing history, as many suspected Liston had thrown the fight due to threats from the Nation of Islam, or in order to take a payoff. Nevertheless, more enduring than any cries of 'fix!' was this image, which shows Ali standing over his laid out opponent, screaming at him to “Get up and fight, sucker!” The scene was snapped by legendary sports photographer Neil Leifer at the ringside, and the picture seems to encapsulate everything the passionate, outspoken champion Ali was about. While not a typical photo portrait, it remains the single most iconic image of the man who proclaimed, “I'm the greatest,” and the most famous and heavily publicized sports photo in history. This famous photo of American literary giant Ernest Hemingway is another by the great portrait photographer Yousuf Karsh. Karsh's mastery of lighting is shown in the picture of 'Papa Bear,' a shot that somehow seems to mirror the stark minimalism of the writer's prose and capture the sense of both melancholy and raw adventure that figured in his life. The portrait, taken at Hemingway's home near Havana in 1957, offers a window into the soul of the big bearded man with elevated eyes wearing a rollneck sweater; a man both intensely imaginative and highly athletic; “A man,” recalled Karsh, “of peculiar gentleness, the shyest of men I ever photographed.” Tortured by alcoholism and ailing physical and mental health, Hemingway blew his brains out with a shotgun in 1961. Is the anguish of his world-weary existence expressed in this photo as it was in the words of his books?

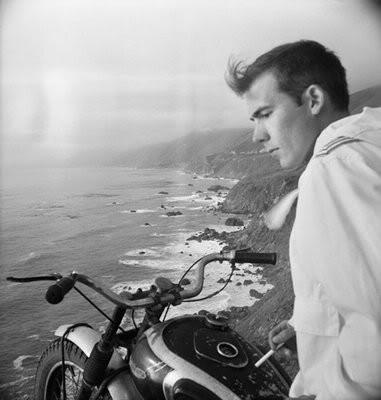

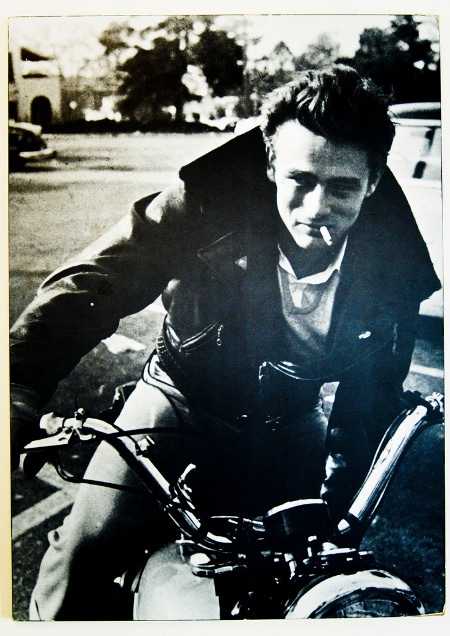

This famous photo of American literary giant Ernest Hemingway is another by the great portrait photographer Yousuf Karsh. Karsh's mastery of lighting is shown in the picture of 'Papa Bear,' a shot that somehow seems to mirror the stark minimalism of the writer's prose and capture the sense of both melancholy and raw adventure that figured in his life. The portrait, taken at Hemingway's home near Havana in 1957, offers a window into the soul of the big bearded man with elevated eyes wearing a rollneck sweater; a man both intensely imaginative and highly athletic; “A man,” recalled Karsh, “of peculiar gentleness, the shyest of men I ever photographed.” Tortured by alcoholism and ailing physical and mental health, Hemingway blew his brains out with a shotgun in 1961. Is the anguish of his world-weary existence expressed in this photo as it was in the words of his books? While it may look camp today, back in 1954 this image symbolized youth rebellion in the extreme, and it is also arguably the most famous picture of Marlon Brando – the mercurial method actor who set new standards for presence on the big screen. It was the publicity shot used on the poster for outlaw biker movie The Wild One, a landmark in cinema history in which Brando starred with his brooding portrayal of gang leader Johnny Strabler. The image of a young punk astride a Triumph Thunderbird motorcycle became iconic, a distillation of all the movie represented with its depiction of a violent subculture whose roaming protagonists could take over towns. Highly controversial at the time over claims that such anti-social behavior was being romanticized, the movie – and photo – kick-started a craze for leather jackets and macho attitudes. The biker counter-culture was born.

While it may look camp today, back in 1954 this image symbolized youth rebellion in the extreme, and it is also arguably the most famous picture of Marlon Brando – the mercurial method actor who set new standards for presence on the big screen. It was the publicity shot used on the poster for outlaw biker movie The Wild One, a landmark in cinema history in which Brando starred with his brooding portrayal of gang leader Johnny Strabler. The image of a young punk astride a Triumph Thunderbird motorcycle became iconic, a distillation of all the movie represented with its depiction of a violent subculture whose roaming protagonists could take over towns. Highly controversial at the time over claims that such anti-social behavior was being romanticized, the movie – and photo – kick-started a craze for leather jackets and macho attitudes. The biker counter-culture was born. One of rock music's most well-known frontmen, Jim Morrison has left a legacy that refuses to die, and his music aside, none of this is captured better than in this 1967 black-and-white photograph by Joel Brodsky. The shot was taken in New York as part of 'The Young Lion' series, the photos of which were used on the covers of The Doors' first two records, as well as many books, compilation albums and other merchandise. Morrison, a self-styled enigma, died of a drug overdose in a Paris apartment in 1971, but this instantly recognizable image shows him at the peak of his artistic powers and still in great physical shape – a sex symbol and a music icon audiences went wild for. In the portrait of the American Poet, we see the singer bare-chested, arms outstretched, drunken, charismatic eyes gazing into the camera lens – intoxicating an already turned on generation.

One of rock music's most well-known frontmen, Jim Morrison has left a legacy that refuses to die, and his music aside, none of this is captured better than in this 1967 black-and-white photograph by Joel Brodsky. The shot was taken in New York as part of 'The Young Lion' series, the photos of which were used on the covers of The Doors' first two records, as well as many books, compilation albums and other merchandise. Morrison, a self-styled enigma, died of a drug overdose in a Paris apartment in 1971, but this instantly recognizable image shows him at the peak of his artistic powers and still in great physical shape – a sex symbol and a music icon audiences went wild for. In the portrait of the American Poet, we see the singer bare-chested, arms outstretched, drunken, charismatic eyes gazing into the camera lens – intoxicating an already turned on generation. Perhaps the greatest mind of the 20th century, Einstein needs no introduction: the proponent of the general theory of relativity shook the very foundations of physics and lay the foundations for the Atomic Age. This is perhaps his most famous photographic portrait, an image that captures the moment the man synonymous with genius stuck his tongue out at photographer Arthur Sasse, thereby capturing so much more. It is a photo that has helped crystallize Einstein's image as the brilliant yet nutty scientist in the popular consciousness, yet it also shows his human side: the Princeton professor celebrating his 72nd birthday with the irreverence to poke fun at the trailing cameras rather than smile for the fiftieth time. It reveals the rebel in Einstein, a true personality who escaped Nazi Germany in 1933 and who was feeling the chill of the McCarthyite climate at the time the picture was taken. The original was sold for $74,324 in 2009.

Perhaps the greatest mind of the 20th century, Einstein needs no introduction: the proponent of the general theory of relativity shook the very foundations of physics and lay the foundations for the Atomic Age. This is perhaps his most famous photographic portrait, an image that captures the moment the man synonymous with genius stuck his tongue out at photographer Arthur Sasse, thereby capturing so much more. It is a photo that has helped crystallize Einstein's image as the brilliant yet nutty scientist in the popular consciousness, yet it also shows his human side: the Princeton professor celebrating his 72nd birthday with the irreverence to poke fun at the trailing cameras rather than smile for the fiftieth time. It reveals the rebel in Einstein, a true personality who escaped Nazi Germany in 1933 and who was feeling the chill of the McCarthyite climate at the time the picture was taken. The original was sold for $74,324 in 2009. A portrait iconic due to the fact that its subject is not a celebrated figure, documentary photographer Dorothea Lange's picture of a 32-year old mother of seven became a key symbol of the Great Depression and one of America's most famous photos. Taken at a pea pickers' camp in Nipomo, California in 1936 the shot (one of six) of the weather-worn woman, with near-despair etched into her face, alerted a nation to the plight of its people – focusing their suffering, and their strength. The image was reproduced in the press, prompting the federal authorities to send in food to the thousands of starving workers stuck where the picture was taken. However, the relief arrived too late for the widow and her young family; they had already moved on. Though she remained anonymous at the time, in 1976 Florence Owens Thompson revealed herself as the face of the photo that had defined an era.

A portrait iconic due to the fact that its subject is not a celebrated figure, documentary photographer Dorothea Lange's picture of a 32-year old mother of seven became a key symbol of the Great Depression and one of America's most famous photos. Taken at a pea pickers' camp in Nipomo, California in 1936 the shot (one of six) of the weather-worn woman, with near-despair etched into her face, alerted a nation to the plight of its people – focusing their suffering, and their strength. The image was reproduced in the press, prompting the federal authorities to send in food to the thousands of starving workers stuck where the picture was taken. However, the relief arrived too late for the widow and her young family; they had already moved on. Though she remained anonymous at the time, in 1976 Florence Owens Thompson revealed herself as the face of the photo that had defined an era. No photo portrait is more iconic than that of Marxist revolutionary Che Guevara. It has been hailed as the 20th century's most famous photograph, but more than this, it has become part of the fabric of our visual language. The image captures many possible emotions in the 31-year-old Guevara's searching yet defiant expression, according to photographer and lifelong communist Alberto Korda including anger, pain, stoicism, and an “absolute implacability.” The picture was taken in Cuba after a memorial speech by his comrade Fidel Castro after the 1960 La Coubre explosion, with Guevara snapped twice just before he vanished from view. Cropped, it would become not simply the mythic hero's most celebrated portrait, but a meta-symbol of revolution and the global spirit of unrest. Long after Guevara's execution in 1967, modified versions were endlessly reproduced in posters and other media, to the point where its commodification appears to mock the ideals it once represented.

No photo portrait is more iconic than that of Marxist revolutionary Che Guevara. It has been hailed as the 20th century's most famous photograph, but more than this, it has become part of the fabric of our visual language. The image captures many possible emotions in the 31-year-old Guevara's searching yet defiant expression, according to photographer and lifelong communist Alberto Korda including anger, pain, stoicism, and an “absolute implacability.” The picture was taken in Cuba after a memorial speech by his comrade Fidel Castro after the 1960 La Coubre explosion, with Guevara snapped twice just before he vanished from view. Cropped, it would become not simply the mythic hero's most celebrated portrait, but a meta-symbol of revolution and the global spirit of unrest. Long after Guevara's execution in 1967, modified versions were endlessly reproduced in posters and other media, to the point where its commodification appears to mock the ideals it once represented. Birdman: Sir David Attenborough speaks on the work of Alfred Russel Wallace and the amazing birds of paradise.

Birdman: Sir David Attenborough speaks on the work of Alfred Russel Wallace and the amazing birds of paradise.

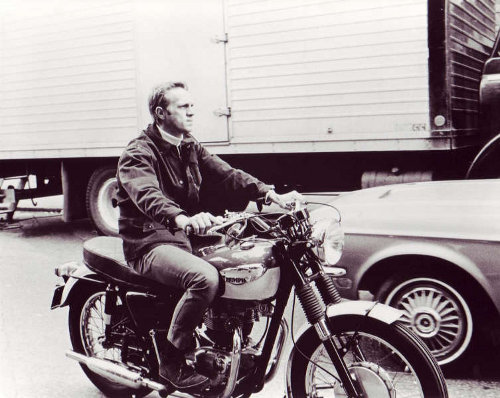

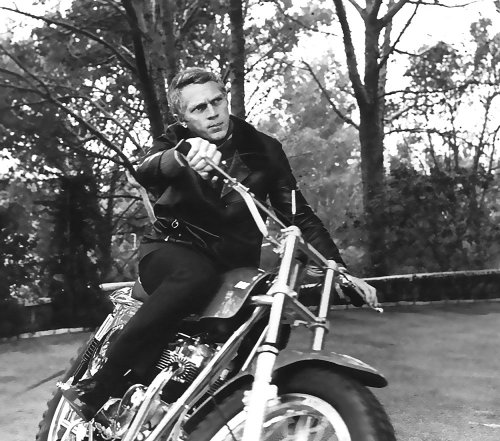

There is perhaps no famous man we associate more with motorcycles than the King of Cool, Steve McQueen.

There is perhaps no famous man we associate more with motorcycles than the King of Cool, Steve McQueen. The TR6 also famously makes an appearance in The Great Escape. In that film, McQueen performed many of his own stunts; however, contrary to popular belief, it was not McQueen who jumped his bike over the barbed wire fence in that iconic scene. Because of insurance concerns, Bud Ekins was called in to make the leap.

The TR6 also famously makes an appearance in The Great Escape. In that film, McQueen performed many of his own stunts; however, contrary to popular belief, it was not McQueen who jumped his bike over the barbed wire fence in that iconic scene. Because of insurance concerns, Bud Ekins was called in to make the leap.